56+ how much should your mortgage be of your monthly income

Looking For Conventional Home Loan. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage.

. Web To qualify for a 450000 mortgage you would need to earn between 135000 and 140000 annually. Web March 3 2023 456 PM. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

For example if you make 10000 every month multiply 10000 by 028 to get. Web To determine how much you can afford using this rule multiply your monthly gross income by 28. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

You can find this by multiplying your income by 28 then dividing. Compare Lenders And Find Out Which One Suits You Best. Web To calculate how much house you can afford use the 25 rule.

Calculate Your Mortgage Payments With Our Free Mortgage Calculator Now. Average income and monthly expenditure according to nationwide data. Ad Calculate Your Monthly Payment with Our Free Online Mortgage Calculator.

Ad 5 Best Home Loan Lenders Compared Reviewed. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web A good rule of thumb is that your total mortgage should be no more than 28 of your pre-tax monthly income.

Ad Take the First Step Towards Your Dream Home See If You Qualify. Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Keep in mind that.

So if you bring home 5000 per month. Check Your Official Eligibility. To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly.

Comparisons Trusted by 55000000. Web The 28 rule refers to your mortgage-to-income ratio. Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Your monthly payment 2500 Affordable Stretch Aggressive Your debt-to-income ratio DTI would be 36 meaning 36 of your pretax income would go toward mortgage.

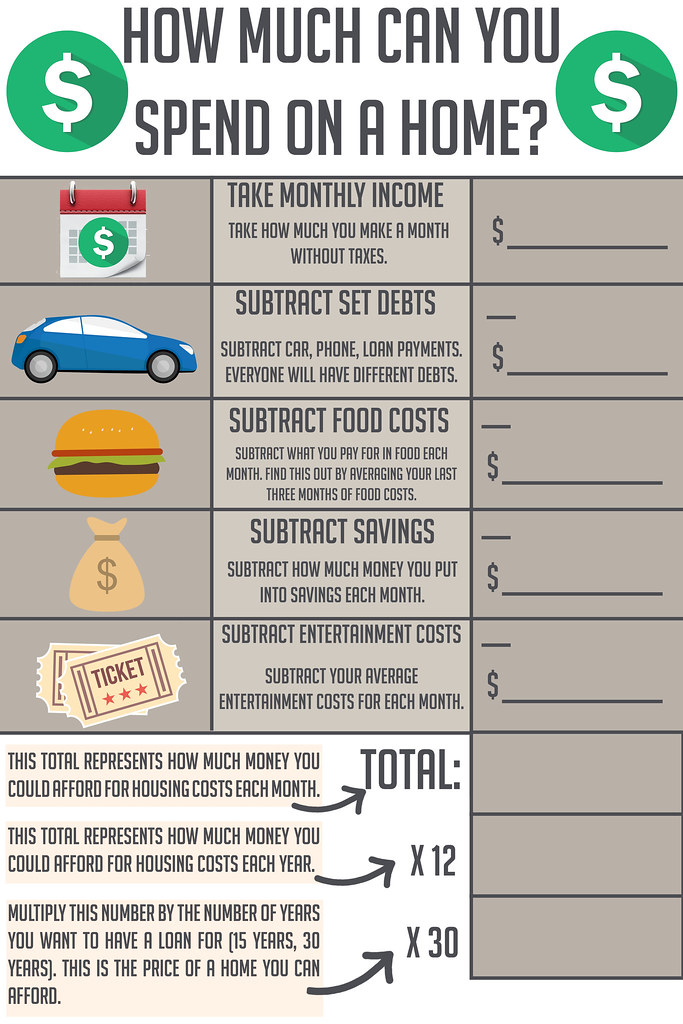

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Never spend more than 25 of your monthly take-home pay after tax on monthly mortgage. Web This number compares your monthly income against your monthly debts to see how much mortgage you could afford alongside your existing payments.

Web Another calculation you can use to find how much of your income you can spend on your mortgage payment is the 25 method. Updated FHA Loan Requirements for 2023. Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent 2000 is 33 of 6000.

Web You want to make sure that your monthly mortgage is no more than 28 of your gross monthly income says Reyes. Scroll down the page for. Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000.

This method allows you to use your net income. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Ad Calculate Your Payment with 0 Down.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Your DTI is one way lenders measure your ability to manage. 5000 x 028 1400.

Web An example would be if you had 100000 in savings and used all of it to finance a 500000 property with a 2500 monthly mortgage payment when your net. 3 mortgage rates will loom large over the US. Results of the mortgage affordability estimateprequalification.

Comparisons Trusted by 55000000. We determined how much youll need for a 400000. John in the above example makes.

Ad 5 Best Home Loan Lenders Compared Reviewed. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage. And you should make.

Ad See how much house you can afford. Compare Lenders And Find Out Which One Suits You Best. Looking For Conventional Home Loan.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Estimate your monthly mortgage payment.

How Much House Can I Afford Moneyunder30

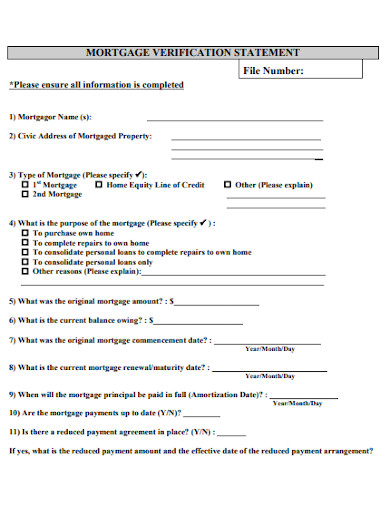

Mortgage Statement 10 Examples Format Pdf Examples

What Percentage Of Income Should Go To Mortgage

How Much House Can I Afford How To Plan For Monthly And Upfront Costs

Here S How To Figure Out How Much Home You Can Afford

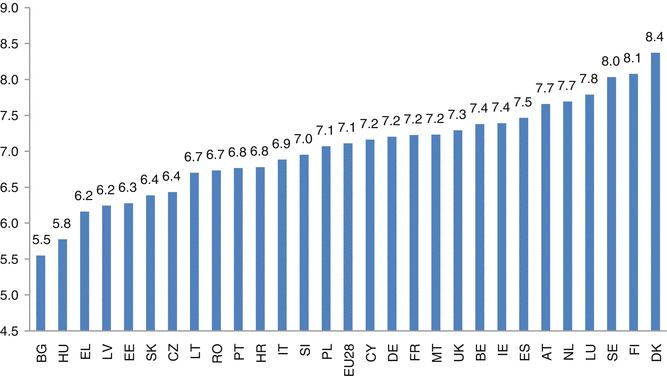

An Overview Of Quality Of Life In Europe Springerlink

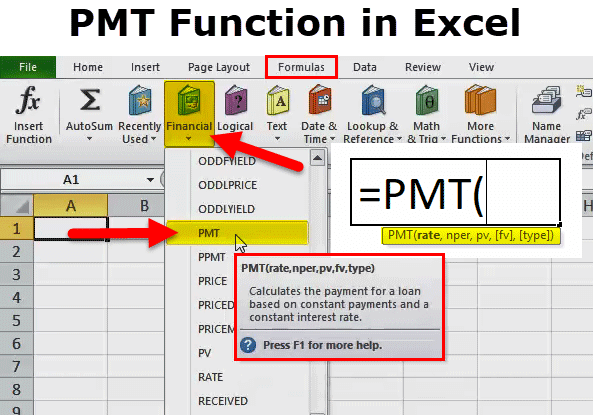

Pmt Function In Excel Formula Examples How To Use Pmt

What Percentage Of Your Income Should Go To Your Mortgage Hometap

Calculate How Much To Spend On A Mortgage Payment

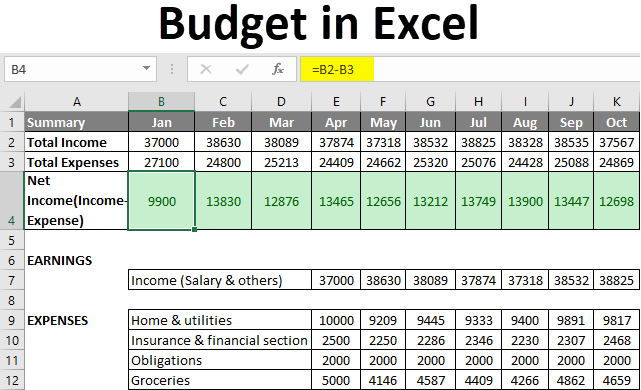

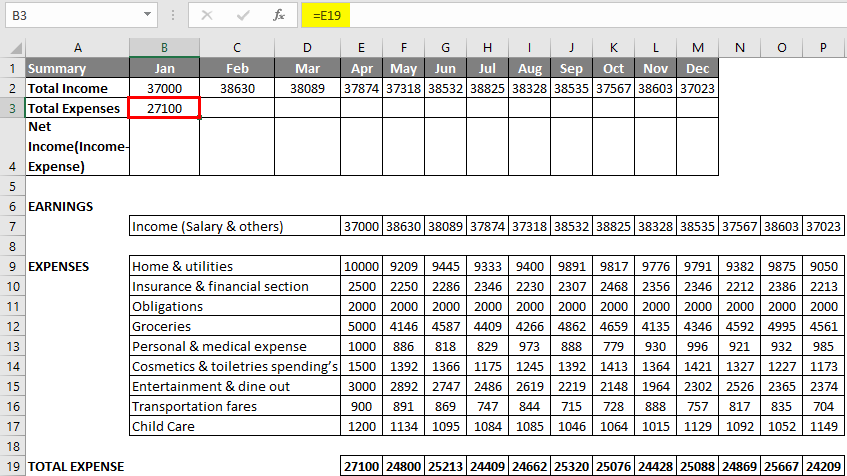

Budget In Excel How To Create A Family Budget Planner In Excel

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Budget In Excel How To Create A Family Budget Planner In Excel

What Percent Of Income Should Go To My Mortgage

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

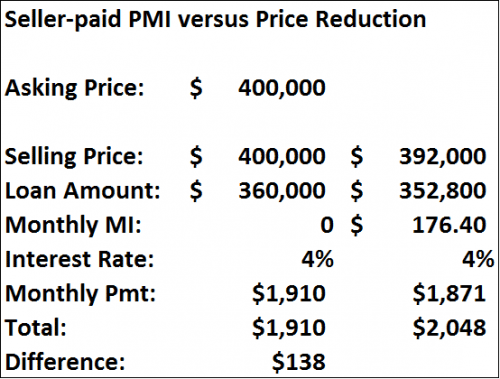

9 Ways To Keep Your Mortgage Payments Low Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Percentage Of Income For Mortgage Payments Quicken Loans

What Percentage Of Income Should Go To Mortgage