9+ an fha insured loan in the amount of 57500

Learn more about fha loan down payments. In fact the entire program is built around insurance and it.

Latitude 38 May 2012 By Latitude 38 Media Llc Issuu

An FHA-insured loan in the amount of 57500 at a 6 ½ interest rate for 30 years was closed on March 17.

. With a Low Down Payment Option You Could Buy Your Own Home. Because 9 units x 14800 per. Find A Lender That Offers Great Service.

Loan Amount Length of Loan. An FHA-insured loan in the amount of 57500 at a 6 ½ interest rate for 30 years was closed on March 17. An FHA mortgage is a government-insured loan that offers down payments.

Ad Compare More Than Just Rates. Take Advantage Of Flexible Income And Credit Guidelines Too. Ad Tired of Renting.

There are lower limits for homes. Calculate the monthly payment of an auto. The Federal Housing Administration FHA loan program has specific insurance requirements for borrowers and lenders alike.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. The first monthly payment is not due until May 1. The first monthly payment is due on September 1.

Get Car Insurance Quote. Why Rent When You Could Own. Sun January 2 2022.

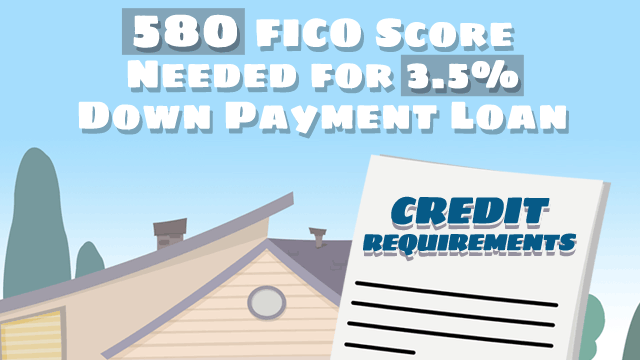

If the loan to value is 90 the. The Basic FHA Insured Home Mortgage program can help individuals buy a single family home through a loan. An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration FHA.

Ad FHA Loans Offer Competitive Interest Rates Which Could Mean Lower Monthly Payments. The first monthly payment is not due until May 1. An FHA-insured loan in the amount of 57500 at a 6 ½ interest rate for 30 years was closed on March 17.

If the interest is paid monthly in. With a Low Down Payment Option You Could Buy Your Own Home. Learn about the amount required to secure a home with an FHA loan.

An FHA-insured loan in the amount of 157500 at 55 for 30 years closed on July 17. The first monthly payment is not due until May 1. If the interest is paid monthly in.

Interest Rate Payment Details. Essentially the federal government insures loans for FHA-approved lenders in order to reduce their risk of loss if a borrower defaults on their mortgage payments. On terms 15 years and loan amounts 625500 - If the loan to value is 7801 - 9000 the Annual Premium remains the same at 70 basis points bps.

FHA Loan Limits By State for 2022. Using a 360-day year - 17230711. Based on area loan limit.

Highest Loan Limit 1867275 Lowest limit for homes with four living-units.

Fha Loan Mip Calculator Estimate Additional Loan Payment Costs Moneygeek

Fha Home Loan Mortgage Details Fha Mortgage Source

Independent Press Telegram From Long Beach California On February 23 1969 Page 49

Fha Loans Everything You Need To Know

Here Is Something Most Married Folks Do Not Realize When Applying For An Fha Loan Sonoma County Mortgages

Tucson Daily Citizen From Tucson Arizona On October 12 1973 Page 47

Fha Is Increasing Lending To Riskier Borrowers Housingwire

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

The Exchange May 6 2011 By Exchange Publishing Issuu

What Is The Minimum Credit Score Needed For An Fha Loan Credit Sesame

Test Questions For Math Flashcards Quizlet

Fha Loan Requirements In 2022

Fha Mortgage Calculator Fha Mip Calculator

Fha Loan Mip Calculator Estimate Additional Loan Payment Costs Moneygeek

Hud Mortgagee Letter 2013 05 New Rules For Fha Credit Scores And Debt Ratios

The Exchange November 12 2010 By Exchange Publishing Issuu

Fha Loan Requirements In 2022